Cheque Bounce in Bangladesh- What to do in 2022

This article will provide a comprehensive overview of the issues surrounding cheque dishonour or cheque bounce, specifically the laws governing cheque dishonour, legal recourse for cheque dishonour, punishment, liability of loan guarantor in case of cheque bounce, and so on in Bangladesh.

What exactly is a negotiating instrument?

A negotiable instrument is any document that guarantees the payment of money, either immediately or at a later date.

Negotiable Instrument Types:

A promissory note is a written instrument signed by the maker that contains an unconditional undertaking to pay a specific amount of money to a specific person or the bearer of the instrument at a fixed or determinable future time or on demand. The phrase “on demand” refers to a note that is payable immediately or at sight.

Cheque and Cheque Disgrace:

A bill of exchange drawn on a specific banker that is only payable on demand; it is issued for immediate payment.

Bouncing a cheque means depriving someone of the money they deserve! Therefore, according to the law of the country, it is a criminal offence

What exactly is a cheque bounce or a cheque dishonour event?

If a person pays someone’s dues by cheque and the bank refuses to pay the money to the person concerned, it is called a cheque bounce or cheque dishonor. Most of the time such incidents happen due to lack of money in the account.

What steps can the creditor take if the cheque bounces?

In this case, the creditor can file a written complaint under Section 138 of the Negotiable Instrument Act, 181 and also file a civil case for recovery.

How to file a written complaint under Section 138 of Negotiable Instrument Act, 181?

A demand notice has to be sent to the creditor within 30 days of bouncing the cheque. If the money is not received within 15 days of receiving the notice, a complaint can be lodged with the district magistrate.

Is bouncing a cheque a criminal offense?

According to Section 138 of the Negotiable Instrument Act, 181, it must be treated as a criminal offense.

In this case, the person who gave the cheque, what is the punishment?

According to Section 138 of the Negotiable Instrument Act, 181, the person concerned is liable to imprisonment for a maximum of two years or double the amount of the cheque or in both cases.

Table of Contents

Find the subsections below, If you want to jump through specific sections instead of reading the whole article.

What to do When Cheque Dishonour or Bounce in Bangladesh? How can you take legal actions to retrieve your money? This post provides complete overview of how to deal with cheque dishonouring in Bangladesh.

Cheque Dishonour or Bounce in Bangladesh

The Bangladesh government has taken a number of steps to provide adequate legal remedy in order to address and mitigate this situation.

Cheque Dishonour or Bounce – In Laws of Bangladesh

Furthermore, a cheque has been defined in case law as an order issued by a creditor to a debtor to pay the whole or part of a debt to a third party. If a cheque fails to clear due to insufficient funds, or if the person who gave the cheque directed his bank to cancel the said cheque, or for any other reason, the remedy is provided by Section 138 of the NI Act.

The court will first consider whether the cheque was presented to the bank for withdrawal within six months of being given to the person who is suing. If the cheque was presented to the bank for withdrawal after six months of it being given to the person who was wronged, the court will dismiss the claim.

If the cheque is presented within the required time frame and the cheque is dishonoured, the aggrieved party must send a written notice via registered post with acknowledgment due to the person who gave the cheque demanding the money back, according to Section 138 of the NI Act.

This notice requesting the money must be sent within 30 days of the cheque being bounced, which is when the aggrieved party was notified that the cheque that was given bounced due to insufficient funds or any other reason. Again, if the notice demanding payment is not sent within the required time frame, the court will provide no remedy.

If the above-mentioned procedure is followed and the person who received the notice does not pay back the money within 30 days of receiving the notice, the aggrieved party may file a civil claim against that person to recover the money.

Finally, in cases of dishonoured cheques, the time it takes to complete all of the necessary procedures before filing a claim is critical. The NI Act is both balanced and timely, so it is well equipped to deal with and provide effective remedies in cases of dishonoured cheques.

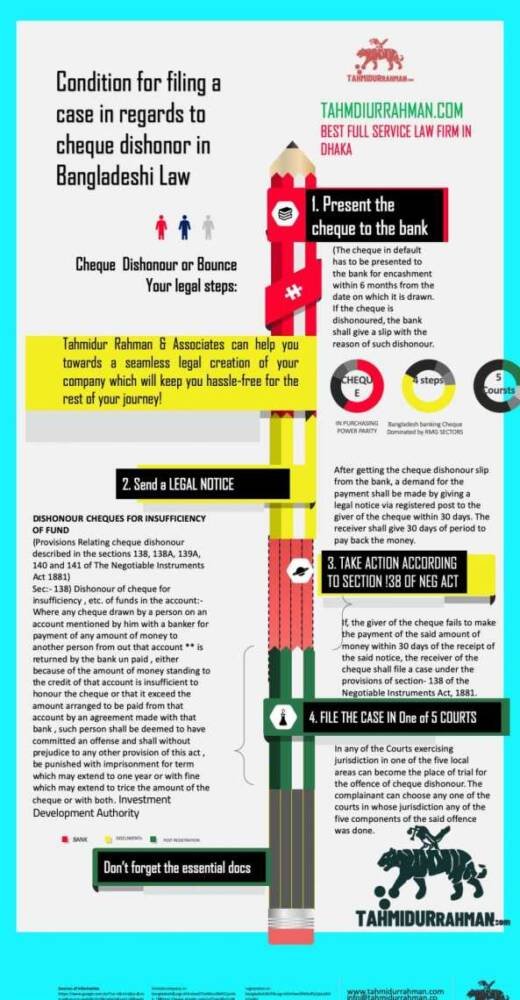

Steps of Filing a Case for Cheque Bounce in Bangladesh

Under the following conditions, the recipient of the check may file a case against the applicant:

(A) Depositing the check at the bank:

The default check must be presented to the bank for encashment within six months of being drawn. If the check is dishonored, the bank must issue a slip as a result of the dishonour.

(B) Legal Disclaimer:

After receiving a check dishonor slip from the bank, the payment application must be made by notifying the check’s giver via registered mail within 30 days. For the next 30 days, the recipient will return the money.

Section 138 Implementation

Unless the giver of the check fails to pay the stated amount of money within 30 days of receiving the notice, the receiver of the check shall file a case under Section 138 of the Negotiable Instruments Act, 1881.

Can criminal and civil cases be filed simultaneously if the cheque bounces?

Yes.

What if the cheque bounces from the guarantor’s account?

In this case too, the matter will be treated as a punishable offense under Section 138 of the Negotiable Instrument Act, 181, why the guarantor cannot evade his liability.

In which cases cheque bounce is not a punishable offense?

- If someone makes an advance payment by cheque even though there is no obligation to pay.

2. Cheque if given as security.

3. If there is a discrepancy between the amount of money written in the spelling and the number.

4. If the attestation of the chequeer is urgent.

5. If the cheque is torn.

. If you give a cheque as a gift or grant to an organization.

What happens if the cheque giver agrees to pay?

If the cheque payer pays the full amount including interest and fine within the time fixed by the court, the case is closed.

How many times can you sue if you bounce a cheque?

In this case, one case is counted for every three cheques. As such, if 8 cheques bounce, two cases will be filed.

Essential documents you need if you would like to file a case against a dishonoured cheque in Bangladesh

- The dishonoured cheque

- Bank slip regarding cheque dishonour

- Copy of legal notice

- Postal receipt and acknowledgment letter of legal notice

- Copy of newspaper where legal notice is published, if any

- Authorization letter or power of attorney if ‘Authorized Agent’ files the case

- List of witnesses

- Costs of the case such as Court fee, lawyer’s fee etc.

- Government or private legal aid if unable to bear the costs of the case

- Intention to go for settlement with the offender to get the money.

PENALTY FOR CHEQUE DISHONOUR or Bounce in Bangladesh:

The offender who commits the dishonor of the cheque shall be punished with imprisonment for a term of up to one year or with a fine of up to three times the value of the cheque or both.

Skyscrapers in Bangladesh

Subscribe to our Awesome Newsletter.

Charterer’s Liability in Bangladesh

Charterer's Liability in Bangladesh Charterer's Liability in Bangladesh Charterer's Liability in Bangladesh In the absence of tangible cargo loss or damage, cargo claims may also be filed. This occurs when the ship furnishes inaccurate descriptions of the quantity,...

Bank Guarantee in Bangladesh

Barrister Remura Mahbub22 March 2016 Updated in 2022 August.A bank guarantee in Bangladesh is a promise made by a bank or other financial institution that if a borrower defaults on a loan, the bank or institution will cover the losses. Through this bank guarantee, the...

Divorce Law in Bangladesh – How to give a Divorce or get one in 2022 | For All major 4 Religions

Barrister Remura Mahbub22 March 2016 Updated in 2022 August.The divorce law in Bangladesh and the procedure to obtain one in Bangladesh is fairly straightforward and inexpensive compared to other nations. In Bangladesh, the bulk of the population is Muslim, and the...

NGO Registration Process in Bangladesh in 2023| Everything you need to know about NGO and Charity Formation in Bangladesh

Barrister Remura Mahbub22 March 2016 Updated in 2022 August. A non-governmental organisation is a legal institution that is not a direct member of a government, is free from government control, and is not a direct political rival. Generally, NGOs are founded by a...

Barrister Remura Mahbub22 March 2016 Updated in 2022 August.Shares in a company registered in Bangladesh are movable property that can be transferred in accordance with the company's Articles of Association. According to Section 2(1)(v) of the Companies Act of 1994,...

Partnership Registration in Bangladesh in 2022

Partnership Registration in Bangladesh in 2023 in Bangladesh Advocate Wahid22 March 2016 Updated in 2022 August.What is a Partnership Business in Bangladesh? A partnership is a business structure in which two or more partners form an entity to conduct business. A...

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.